A Practical Guide to Improving Fund Settlement Through ACH

What is an ACH transfer?

It is an electronic payment that moves money between bank accounts through a centralized network (Automated Clearing House). ACH network processes these transactions in batches and this post is specifically about this - batching. How to play with time within the batch clearings and how to reduce your float.

Now what is a Same Day ACH transfer?

It uses standard ACH rails but the batches are cleared multiple times a day rather than just once.

Think of these as two trains - one makes one stop to pick up all the passengers and then drops them all off at the same station.

The other train (Same Day ACH) makes 3 stops where they can pick up and drop off passengers.

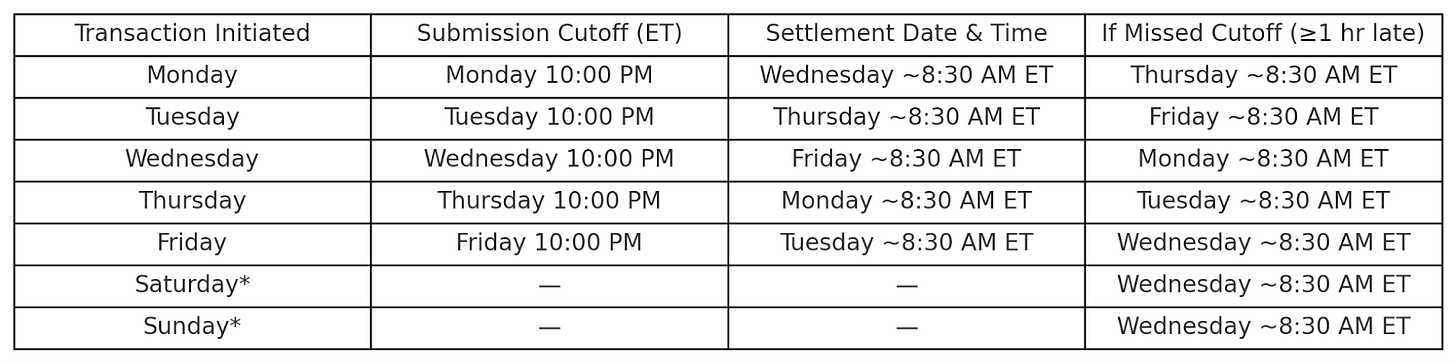

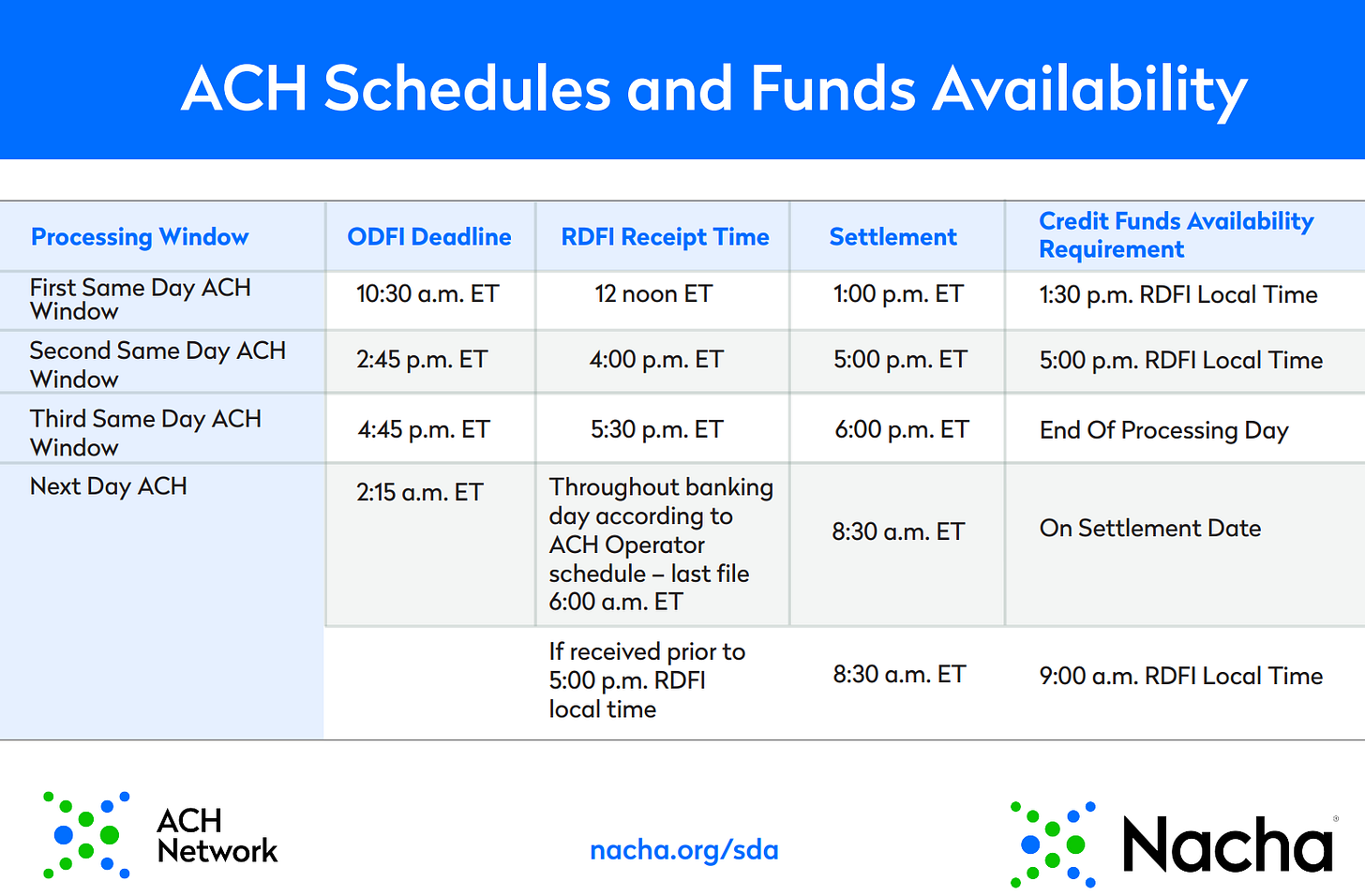

Here is the schedule for standard ACH settlement times, the cutoffs by which the transactions have to be created and further explanation of specific times of when you can expect an ACH to be settled.

Google somehow managed to fail me in this quest so this had to be created manually with the assistance of my arch nemesis ChatGPT.

Important thing to note here is that the cutoff times are in EST AND these cutoff times are the formal Federal Reserve’s cutoff times. The vast majority of banks and subsequently, PSPs (including Checkbook) limit their cutoff times further to 8pm EST. The settlement time remains the same.

Here is the schedule of the said train (Same Day) provided by Nacha:

What rail should you use to optimize the delivery speed of your funds?

This question will be answered once you understand how the batching works as well as how payment providers factor into all this and how they can affect the funds delivery time.

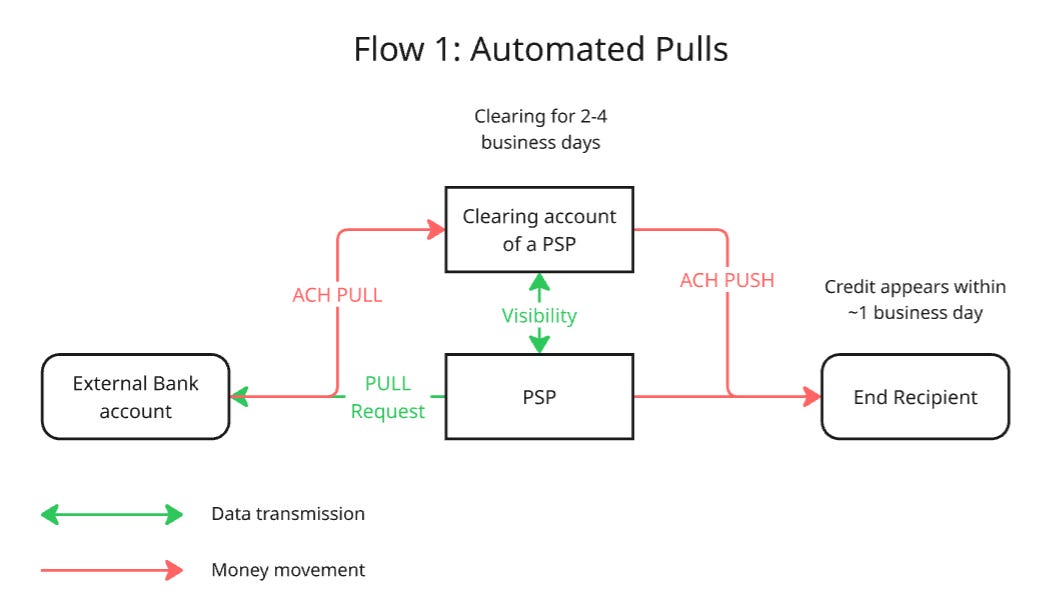

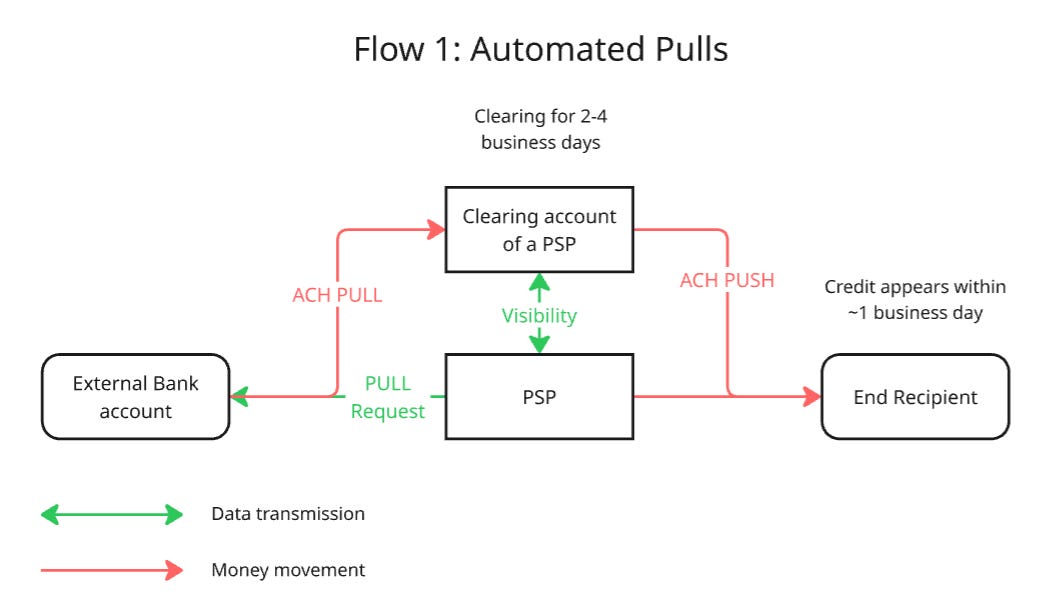

ACH has two parts - a debit (pulling) and a credit (pushing). Flow 1 describes the situation when you use a PSP (Payment Service Provider):

-

Day 0: we initiate a debit

-

Day 1-3: bank has 3 days to notify us of a return - Insufficient Funds, Unable to Locate Bank, etc. During this time the funds technically reside in Checkbook’s accounts and could be pushed out to the end recipient but doing so would expose Checkbook to substantial risk.

-

Day 3 (afternoon): once the window has passed and no return is received, we initiate a credit.

-

Day 4 (morning): credit is received.

Here is the breakdown of times that are involved in the standard ACH:

-

If the client submits a payment before the cutoff time of 5pm PST, the debit will be initiated the same day around 5pm PST.

-

If the client submits a payment after the cutoff time of 5pm PST, the debit will be initiated the next day around 5pm PST.

Here is the simplified standard flow of funds and data within this process:

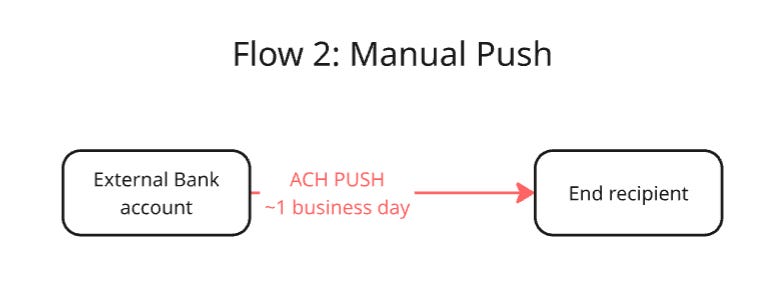

Flow 2 – Manual Push by the User.

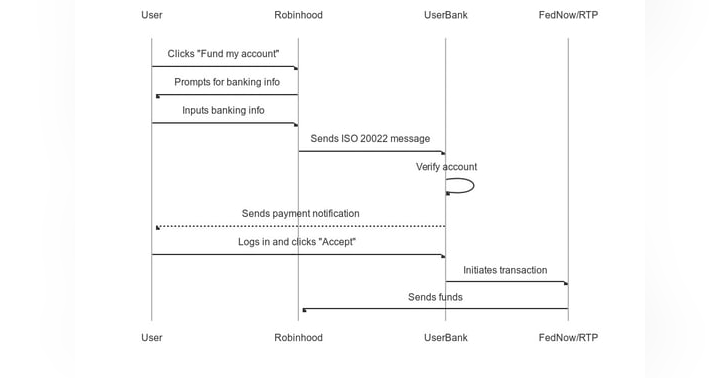

This solution relies on the user logging into their external bank account, adding the credentials of their wallet (described later) or a custodial account and sending funds directly to that account.

Here is the visualization of this simple flow:

Now, the basic truth - you can’t do a Same Day ACH pull. Physically can’t be done, same to any other instant payment rail: RTP, FedNow, Zelle, Venmo and anything else that you can think of. This is because any PSP or even a bank that isn’t related to a bank from which the funds will be pulled, don’t have the visibility into the funds availability within the account that will be debited.

A small exception is the RFP - Request For Payment which allows you to “pull” FedNow and RTP from qualified banks but this is a very rare and not readily available solution.

Summary of the key point.

Taking into account the basic truth from above, we know that the current best pull option is standard ACH. Cheap, reliable and safe.

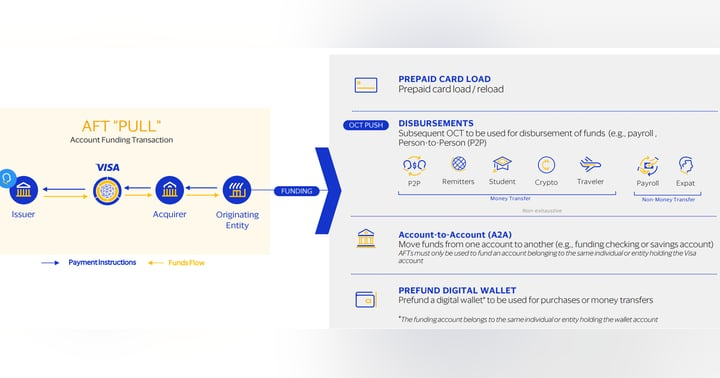

As time goes by, there are workarounds being created (RFP is a good example) as well as new methods of pulling funds entirely - for example AFT (I will make another post about that later).

But for the moment, the three main ways that you can meaningfully improve the speed of fund delivery and subsequent reduction of your float are:

-

Asking your clients to go to their external bank account and sending funds directly to their issued wallet. These wallets (custodial accounts) can be issued to every single user and will contain an account and routing number. This means that such an account can function as both an Originating Depository Financial Institution (ODFI) and a Receiving Depository Financial Institution (RDFI) which allows users to push funds directly to such a wallet from their external bank account using Same Day ACH, Wires or even RTP and FedNow AND it allows them to push the funds from this wallet further.

-

Enabling reverse wires. This is only applicable to enterprise clients who are transacting at the very least $5,000 per week since it does involve a substantial amount of manual work for implementation. But this will allow you to pull wires from any external bank account that has been enabled, quite a unique and not widely known solution that I just may dig into soon enough.

-

By expediting the second leg of the transaction. Refer to the Flow 1 to see the second leg (push). This is the most frequent request that I have seen, hence I will focus on this one and explain how it can be done through Pre-Debit which has nothing to do with pre-funding.

Pre-Debit.

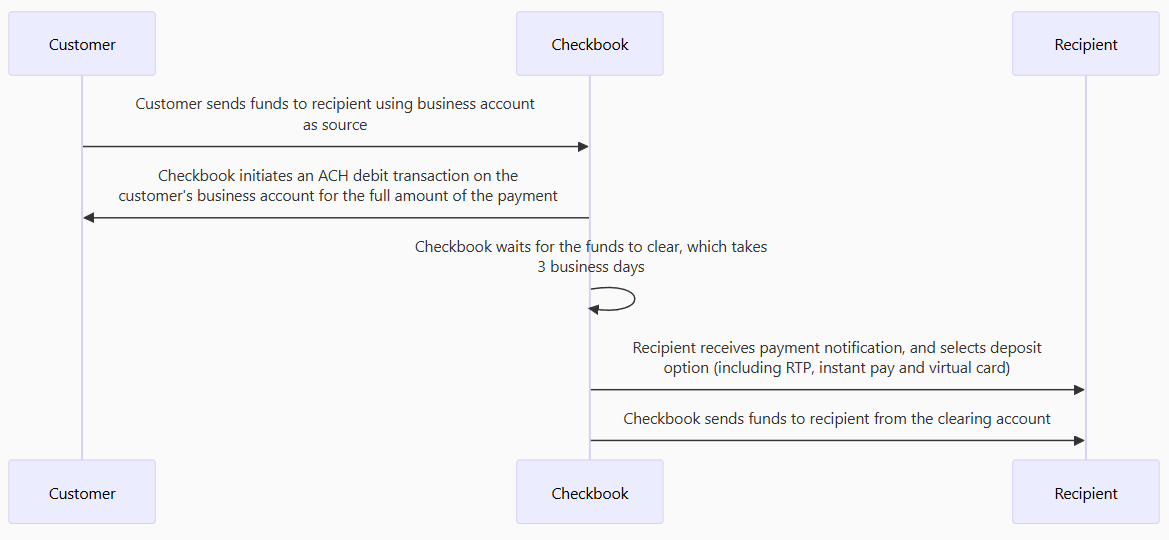

In this setup, we (i.e. Checkbook, I am not aware of other PSPs that can support a flow like this) can create a flow in which the pull will happen via ACH and the push happens through one of the instant rails like RTP, FedNow, Paypal or whatever else your user chooses and whatever is enabled through your PSP.

To simplify this, view the Flow 1 above. In that flow, instead of the funds settling through Checkbook’s account, they will be settled into a user’s wallet (custodial account). Once the funds settle, Checkbook has visibility into the funds, meaning that we can now facilitate the instant push from the said wallet.

And of course this also means that the second leg of the transaction works 24/7 - no holidays.

This means that instead of waiting for potentially up to 5 business days, your users will receive funds within 3 business days.

This ALSO means that you can schedule payments to be disbursed through the weekend. Now, if you have a payment that is

Here is the flow of its own:

The bottom line of all this is: you can get creative with your flow of funds. It is quite fun and there are so so so many things that you can do SO if you have any further questions, shoot me a note and I'll be happy to get creative with you!

That will be a wrap, hope you found this post helpful!