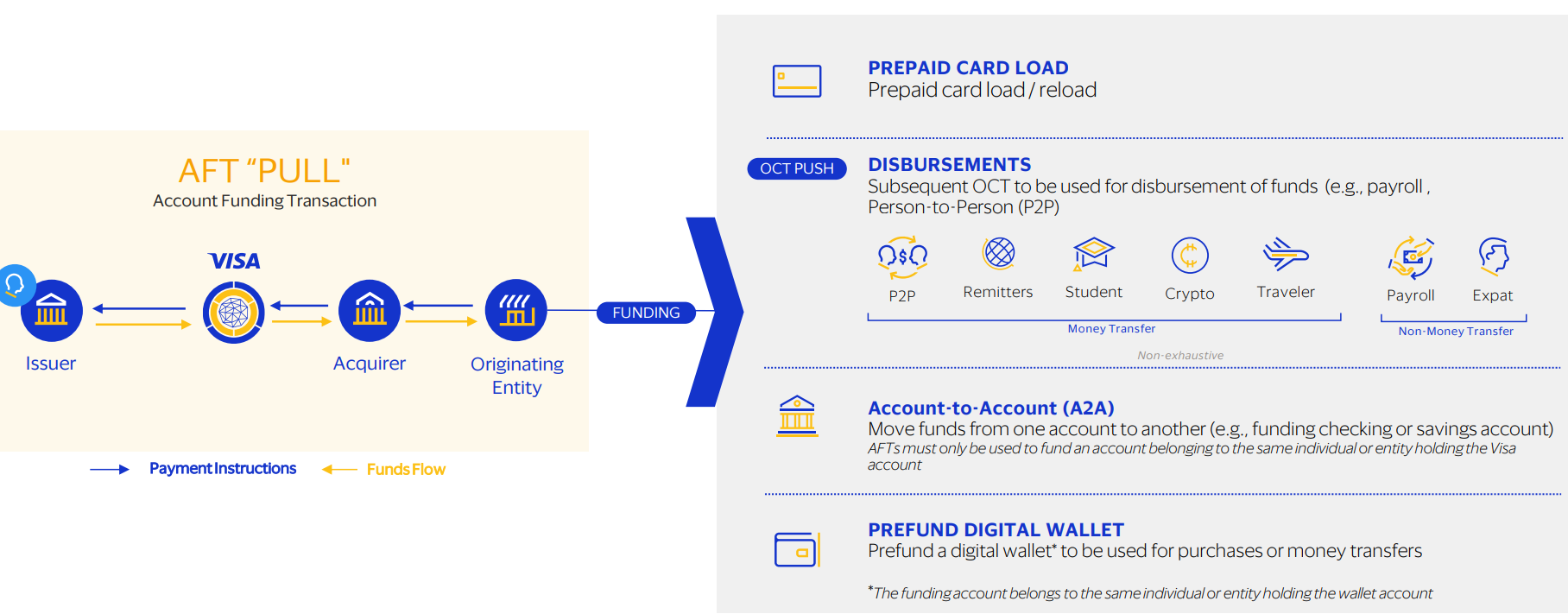

AFT: instant debit pulls through Account Funding Transactions.

What is AFT?

According to Visa’s official documentation, Account Funding Transactions (AFTs) is a transaction type used to withdraw funds from a Visa or Mastercard account for the purpose of funding another account. In simple words - it is an inverse of OCT (Original Credit Transfer).

In simpler terms, it means that any user can input their debit card (Visa or Master) and the transaction originator can pull the funds from the bank account connected to the said debit card. Not only is AFT cheaper than standard debit rails, the funds will also settle MUCH faster.

So in even simpler terms, AFT gives you the ability to pull funds from users’ debit cards almost instantly. I’ll go into further detail on settlement delays, comparisons to standard debit processing rails and more so stick with me!

How is AFT pull structured?

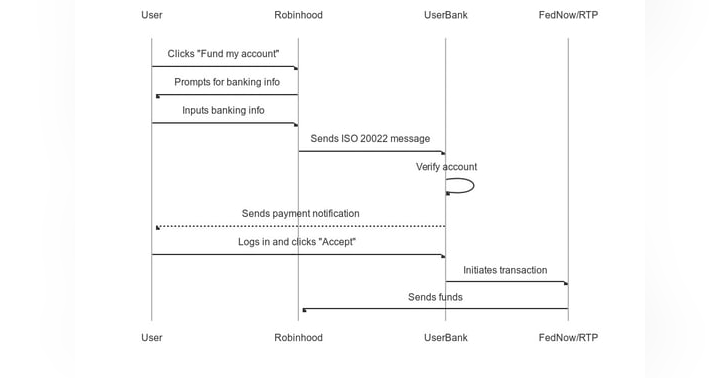

Let’s take a scenario where a Tom - a user of XYZ investment platform wants to add funds to their account within XYZ in order to invest in stocks. Here is how it would look like with an AFT pull:

Step 1: Cardholder initiates AFT transaction using mobile app. Merchant captures & verifies payment request and notifies the sender.

— Tom clicks the button saying “add funds” and enters his debit card information and XYZ takes it in.

Step 2: Enabler initiates a transaction and sends AFT message to VisaNet.

— XYZ sends a request to enabler (usually a PSP like Checkbook) to initiate the AFT pull, passing along the information that was acquired from Tom - card information, address, SSN and any other relevant information. The enabler processes the request and pushes it to VisaNet.

Step 3: Visa routes the AFT to the funding issuer.

— Visa pushes the request to the bank that is associated with Tom’s debit card.

Step 4: Issuing bank authorizes the AFT request; funds pulled from the sender’s account & pushed to a specified receiving account.

— Tom’s bank processes the request, ensures that everything is in order and debits Tom’s bank account. After the debit, they route the funds to Tom’s account within XYZ as per Visa’s request.

Step 5: Funds are cleared and settled into the receiving account whatever it may be.

— The funds settle into Tom’s account ~30-40 minutes later (or less) and Tom gets notified by XYZ that he has the balance available to invest. Tom is happy that he can now buy the market dip. XYZ is happy that they don’t have to front the funds to the customer but at the same time can allow Tom to start trading almost instantly. Everyone is happy.

When and how to use AFT?

Here are some of the use-cases that are listed by Visa itself, a few have specific examples that my big brain came up with to make it easier to envision:

- Brokerage. Example: see Tom’s use-case from the last part.

- P2P (Peer-to-Peer). Example: I want to send my friend a payment through a new company XYZ Fast. I connect my debit card, click “pay Friend 1” and the funds are pulled via AFT into my own wallet hosted within XYZ Fast (see Omnibus Accounts to learn more about those wallets). The funds settle in under 30 minutes and then are pushed to my friend’s wallet within XYZ Fast from which they can withdraw the funds into their external bank account via RTP, FedNow or other instant rail.

- Insurance

- Marketplaces

- Supplier Payments

- Merchant Settlement

- Gaming. Example: I want to buy a skin for my PUBG account (I’m that old). I connect my debit card, click “buy”, receive my skin instantly and the PUBG developer gets the funds settled into their merchant account in 30 minutes.

- Healthcare

- Remittances

The list is far more extensive and covers a lot of areas but I decided not to take up the whole post with such a list. Get creative with your applications and if you need to borrow some creativity from this big brain, reach out to me directly at kdubovitskiy@checkbook.io ;)

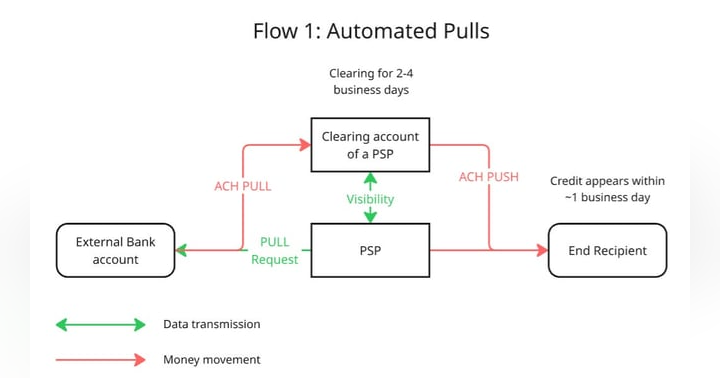

The settlement delays.

What is the settlement delay for an AFT? It depends on the provider that you choose but it can range between 2 business days and 30 minutes. Compared to the 3-4 business day delay for standard debit rails this fact alone should make you adopt AFT ASAP. I will cover the full list of pros and cons of AFT later in the article so you’ll see the full picture soon. For now, let’s talk about this difference in the settlement delays and what actually causes them.

According to the official Visa documentation, the settlement timing is listed as following: CPD+0/1/2 depending on client setup. CPD here means Central Processing Date which in turn essentially means when the payment request has been received.

So why is AFT so fast?

The magic lies behind the letter F - Funding. AFT is classified as Funds Transfer which carries a Processing code = 10 and TCQ = 1 rather than a purchase transaction that carries a Processing code = 00 and TCQ = 0 as shown below.

Because of the associated codes, AFTs are processed with real-time authorization from the issuer and cleared immediately which is the main cause of the much lower settlement delay compared to a standard debit rail which use Merchant Batching systems to clear the transactions.

Processing Code indicates the type of transaction being requested - a broad category that defines the type of transfer.

TCQ stands for Transaction Code Qualifier is a more specific identifier within the broader group of processing codes.

Each identifier carries its own set of regulations imposed by Visa, Fincen, compliance enforcers in the form of banks etc. Misrepresenting the transactions as a 10 vs 00 or 1 vs 0 could carry significant repercussions which I will not dig into. Just trust me that it’s not worth it.

Restrictions.

So far absolutely everyone involved in the process is ecstatic and LOVES AFT as they should. But there is a dark side as always - restrictions of use.

As stated previously, one of the key parts that allow AFT to be so fast is that it is a FUNDING transaction, not a purchase transaction. The feature that allows AFT to be so fast is also the cause of some restrictions in how AFT can be used.

Let’s see what those limitations are.

An important note to make here is that cryptocurrency purchases are technically allowed via AFT, however they are considered to be high risk. Since they are considered to be high risk, many of the sponsor banks will not support such a use-case or will have to review it on the case by case basis (frequently resulting in a decline of the application).

In summary, if you think that the transaction can be classified as “purchase”, you can’t use AFT.

If you want to dig deeper, click on the link below that will lead you to a google folder where I’ve assembled the Visa documentation used to create this post.

It requires my approval but I’ll approve anyone who asks for access. I just want to see who is curious enough to dig further:)

AFT with Partial Authorization Service.

This is a unique AFT feature. AFT with Partial Authorization Service allows you to pull less than a requested amount from the payee’s debit card. This may sound counterintuitive until you think of all the nuances. And if you have ever interacted with the payments space you already know how useful this is.

Here is the case study shared by Visa:

Here is what this flow looks like:

- John initiates a transaction for $100

- Merchant sends the authorization request to their acquirer / processor

- Acquirer/Processor sends the transaction to Visa with the partial authorization indicator1

- Visa conducts transaction verifications and forwards the Partial Authorization indicator to the issuer

- Issuer evaluates the transaction, approves the available balance of the Consumer of $75

- The transaction gets passed back to the merchant; John gets notified of the confirmation

This functionality isn’t too wide-spread so I can’t share more on it but I am very much looking forward to seeing this become more popular as the use of AFT grows.

Final Pros and Cons of AFT.

Pros:

- Much faster than almost any alternative pull (exception is RFP) with settlement delay of about 30 minutes.

- Almost non-existent reversal period. The payment can be reversed by the sender within the ~30 minutes it takes for the funds to settle.

- Slightly cheaper than standard debit rails. Debit rails come at about 1-2% (very rough averaged numbers) while AFT is sitting closer to a fixed 1%.

- Additional fraud protections available depending on the provider. AFT can come with the following protections: Account Name Inquiry, Payment Account Validation and Address Verification; 3D Secure 2.0; Visa Token Service; Verifi (the pre-dispute service); Account Takeover Protection, RDR (Rapid Dispute Resolution) and lastly Decision Manager.

All of these protections can come very handy and some are worthy of their own posts but I’ll create those as I encounter each of these protections in real life. - Partial authorization services. Even less readily available than AFT itself and heavily depends on the provider.

Cons:

- Limited use. See the limitations above.

- Limited coverage: covering only Visa and Mastercard issued debit cards.

- Much more expensive than standard ACH pulls. This solution is only viable for those who value decreased settlement delay over costs.

- Limited availability. This rail has been introduced very recently (by the metrics of financial systems) and isn’t widely available. Checkbook.io is amongst the few PSPs that offer AFT

Wrapping up.

To summarize this long long post, AFT is suitable for anyone who needs to proactively pull funds from the users’ external bank accounts in as fast of a time as possible.

There are no alternatives that get even close to AFT when it comes to the settlement speed.