How you can get your customers' funds instantly through Request For Payment.

TLDR:

- RFP is a capability offered by RTP and FedNow rails.

-

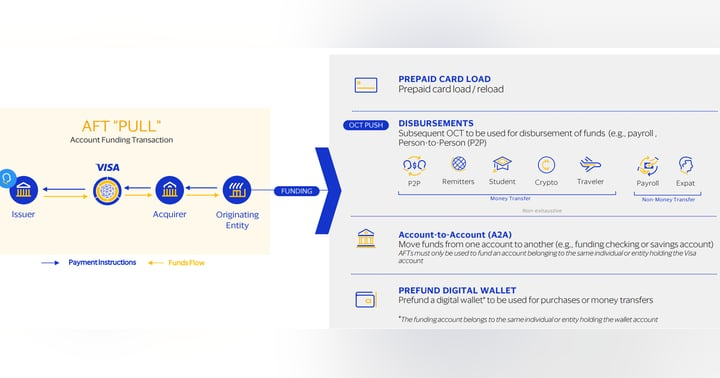

It offers instant “pulls” from users’ external bank accounts without employing AFT.

-

This system offers instant settlement.

-

Main issue of the system is the lack of availability.

-

This will be especially applicable to those who have users with recurring payments or those who are trying to enable your users to fund their wallets within your app.

Now, prepare to be blown away and be underwhelmed at the same time because we are about to talk about RFP. In this article you’ll learn about what is RFP, how does it work, how to implement it and who may support such an implementation.

Yes, you read it right, RFP, not RTP. A lot of abbreviations in the payments space and they all sound the same and they all tend to be related. So what is RFP? RFP stands for Request For Payment and has mind-blowing capabilities because it allows you to pull funds from your users’ external bank accounts with the settlement delay being ~3-5 minutes. In simple terms, it works by allowing an organization or an individual to send a request for an initiation of instant payment by the sender.

If you google Request For Payment you will find only the official documentation from FedNow and The Clearing House (TCH - runs RTP unlike ACH). This is because very few pay attention to this niche goldmine and because it is supported through both FedNow and RTP rails - hence they posted learning materials on it. To clarify - there is no way to make an actual pull from a users’ external account using an instant payment rail like RTP, FedNow or even Zelle but Request For Payment does its magic and allows your users to easily initiate such an instant transaction.

Before we go any further, I like to outline the problem that a tool is solving. In this case - instant funding. You are the owner of Robinhood and you want to make it as simple as humanly possible for your user to start trading on your platform.

Solutions:

-

Front the funds to the user. This is what Robinhood does at least to a degree. This is risky (especially in other forms of business where there is no collateral) and requires a hefty amount of working capital.

-

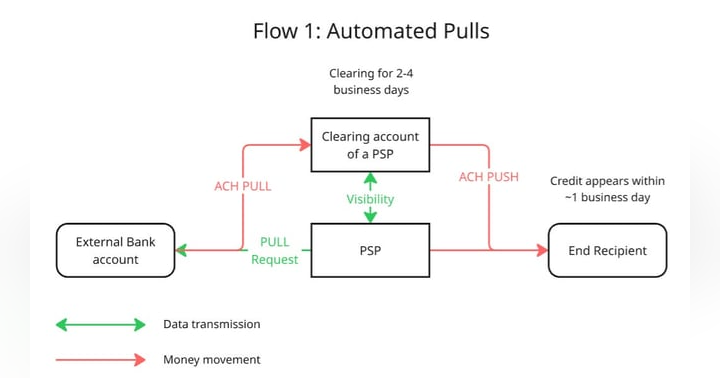

Make the user wait while their ACH pull is being processed. Obvious issue of a user being annoyed with the wait.

-

Enable AFT (Account Funding Transaction) - has its limitations in usage but I strongly believe that this method is the future of most marketplace platforms. We’ll dig into AFT in one of the upcoming articles.

-

Enable RFP. This is what we’ll keep talking about here.

How does the flow of funds look like for RFP?

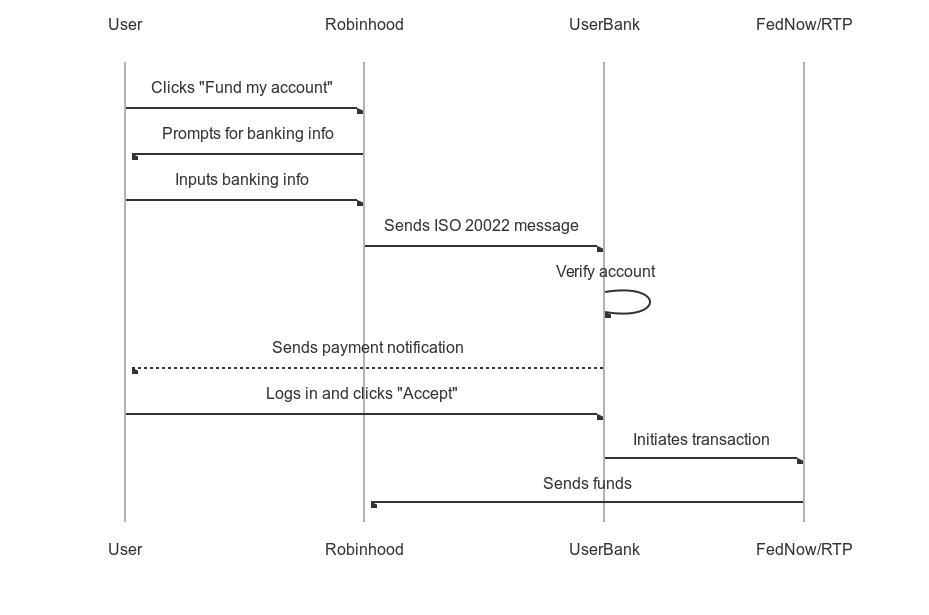

*ISO 20022 just a messaging protocol used by banks to communicate between each other. Not too important but if you ever want to throw around cool jargon it’s a nice to have.

Here is the diagram for the visual learners:

CACHAW. The job is done. The user had to click a few buttons and beyond inputting the banking information (which can be done through Plaid within seconds), all is done within seconds. Sounds amazing, doesn’t it? Now let’s break it down further.

Pros:

-

Funds are settled instantly - this is key to all and has dozens of benefits within it. I won’t write them out though because you can figure those out by yourself for your own use-case.

-

Savings on the credit card processing. This transaction will be processed at a cost of a FedNow or RTP cost which is below $1 regardless of the amount opposed to credit card processing fees.

-

NO CHARGEBACKS. The user authorized the transaction themselves, they proactively went to their bank account and clicked “authorize”. It’s the same as sending someone a Zelle payment - once it’s out it’s out. Done and dusted.

Cons:

-

Availability. RFP is only available in 4 major US banks: JPM Chase, US Bank, Bank of America and Citibank. If a user doesn’t bank at one of those 4, they won’t have access to this technology.

-

Currently the permitted use-cases very between RTP and FedNow rails (FedNow being more laxed) but they are still limited. If you want to allow your users to pay for goods and services, most likely you are doomed to fail. If you don’t fail - please let me know and I would LOVE to interview you for AFT.finance!

I’m looking at this post now and wonder - what took me so long to get to it? It’s absolutely amazing (and simple) just like anything else that comes out of my genius head. It took so long because I had to stumble upon the concept of RFP while completing a course on FedNow Onboarding systems created by a wonderful Payments Professor.

‘Tis the wrap people, I hope you were as excited to learn about RFP as I and will reward me with a generous like or a massive sponsorship (yes, unlike Fundraising Radio, this is a purely for-profit venture).